Unpacking Iran's Economic Outlook: A Deep Dive Into Nominal GDP 2024

Understanding the economic landscape of any nation requires a careful examination of its Gross Domestic Product (GDP). For Iran, a country often at the center of global geopolitical discussions, its economic performance, particularly its nominal GDP in 2024, offers crucial insights into its resilience, challenges, and potential. This deep dive aims to demystify the numbers, providing a clear and comprehensive overview of Iran's economic standing, drawing upon reliable data from institutions like the World Bank and the International Monetary Fund (IMF).

As we navigate the complexities of global economics, understanding a country's GDP is paramount. It serves as a vital indicator, reflecting the total market value of all final goods and services produced within a nation's borders over a specific period. For Iran, the 2024 nominal GDP figures paint a picture of an economy grappling with various internal and external pressures, yet showing signs of growth and adaptation. This article will break down what these figures mean, how they compare globally, and the underlying factors shaping Iran's economic trajectory.

Table of Contents

- Understanding Gross Domestic Product (GDP): The Economic Barometer

- Iran's Nominal GDP in 2024: Key Figures and Global Context

- The Trajectory of Iran's GDP: A Historical Perspective

- Factors Influencing Iran's Nominal GDP

- The Significance of GDP Per Capita in Iran

- What Do These Figures Mean for the Average Iranian?

- Projections and Future Outlook for Iran's Economy

- Navigating Economic Data: Why Sources Matter

Understanding Gross Domestic Product (GDP): The Economic Barometer

Gross Domestic Product (GDP) is arguably the most widely used measure of a country's economic activity. At its core, GDP represents the total market value of all final goods and services produced within a nation's borders over a specific period, typically a year. This comprehensive figure provides a snapshot of an economy's size and health. When we discuss GDP, it's crucial to distinguish between different ways it's calculated and presented. Nominal GDP, which is our focus here, calculates the value of goods and services at current market prices. This means it includes the effects of inflation, making it useful for comparing the size of economies in current U.S. dollars. Countries are typically sorted by their nominal GDP estimates from various financial and statistical institutions, with these figures calculated at market or government official exchange rates. While nominal GDP gives us a direct measure of economic output in monetary terms, it doesn't always reflect the true purchasing power or living standards, especially in countries with high inflation or volatile exchange rates. For that, economists often turn to GDP in Purchasing Power Parity (PPP) terms, which adjusts for differences in the cost of living and inflation rates between countries. The World Bank, for instance, provides estimates for Iran's GDP in nominal terms since 1960 and in PPP terms since 1990, both at current and constant prices, offering a robust historical context for analysis.Iran's Nominal GDP in 2024: Key Figures and Global Context

The year 2024 presents a fascinating picture for Iran's economy, particularly concerning its nominal GDP. According to official data from the World Bank, the Gross Domestic Product (GDP) in Iran was estimated to be worth **436.91 billion US dollars in 2024**. This figure represents a significant marker of Iran's economic output in the current year. It's worth noting that other projections and estimates also exist, with some sources indicating a nominal GDP of around USD 434 billion or even USD 401 billion for 2024. These variations often arise from different methodologies, data cut-off points, or the specific financial and statistical institutions making the projections. However, the World Bank's figure stands out as a widely referenced official estimate, providing a solid basis for our discussion on Iran's nominal GDP in 2024. To put this figure into perspective, Iran's GDP value represents approximately **0.41 percent of the world economy**. While this might seem like a small fraction, it underscores Iran's position as a notable, albeit not dominant, player on the global economic stage. The country's economic size is a testament to its diverse sectors, including oil and gas, agriculture, manufacturing, and services, all contributing to its overall output. Furthermore, the Gross Domestic Product of Iran grew by an estimated **3.5% in 2024 compared to last year**. This growth rate, while modest, indicates a continued expansion of the economy, building on previous years' performances. Understanding these core figures is essential for anyone looking to grasp the current economic standing of Iran.The Trajectory of Iran's GDP: A Historical Perspective

To truly appreciate the significance of Iran's nominal GDP in 2024, it's vital to look at its historical trajectory. Economic performance is rarely static; it's a dynamic interplay of internal policies, external pressures, and global events. By examining past trends, we can better understand the forces shaping the present and future of Iran's economy. The World Bank provides extensive data on Iran's GDP, allowing us to trace its journey over several decades, particularly focusing on the recent past to understand the momentum leading into 2024.Recent Growth Trends (2020-2023)

The period from 2020 to 2023 was marked by significant fluctuations for Iran's economy, reflecting both global challenges and domestic responses. * **2020:** The year 2020 saw Iran's GDP face a substantial contraction. Iran's GDP for 2020 was **262.19 billion US dollars**, marking a **21.39% decline from 2019**. This sharp downturn can be largely attributed to the compounding effects of international sanctions and the global economic slowdown triggered by the COVID-19 pandemic, which severely impacted oil demand and other economic activities. * **2021:** Following the challenging year of 2020, Iran's economy demonstrated a remarkable rebound. Iran's GDP for 2021 was **383.44 billion US dollars**, representing a staggering **46.25% increase from 2020**. This significant surge indicates a strong recovery phase, possibly driven by a partial easing of some pressures or improved domestic resilience and adaptation strategies. * **2022:** The growth continued into 2022, albeit at a more moderate pace. Iran's GDP for 2022 was **394.36 billion US dollars**, a **2.85% increase from 2021**. This steady growth suggests a stabilization of the economy after the volatile period of the pandemic and initial recovery. * **2023:** Building on the momentum, Iran's GDP for 2023 reached **404.63 billion US dollars**, marking a **2.6% increase from 2022**. Another estimate for nominal GDP in 2023 was around USD 373 billion, highlighting the slight variations that can occur between different data sources. The World Bank's figures provide a consistent narrative of gradual, albeit constrained, expansion leading up to the 2024 projections. These year-on-year figures illustrate an economy that, despite facing considerable headwinds, has managed to regain its footing and sustain a positive growth trajectory in recent years. The recovery from the 2020 decline is particularly noteworthy, showcasing the adaptability of Iran's economic structure.Quarterly Dynamics and Nominal Growth

Beyond annual figures, looking at quarterly data provides a more granular view of economic shifts. For instance, Iran's nominal GDP reached **429.4 billion US dollars in March 2022**, consistent with the previous quarter. This indicates a period of stability in nominal terms during that specific timeframe. However, it's crucial to understand the distinction between nominal GDP growth and real GDP growth, especially when looking at the high percentage figures sometimes reported for nominal growth. Iran's nominal GDP growth was reported at **35.070% in March 2024**, which represents a decrease from the **37.422% recorded for December 2023**. These exceptionally high nominal growth rates, when viewed in isolation, might seem to contradict the more modest 3.5% annual GDP growth reported for 2024. The key lies in understanding that nominal GDP growth can be significantly inflated by high domestic inflation and currency depreciation against the US dollar. While the actual volume of goods and services produced (real GDP) might grow by a moderate percentage (like 3.5%), the monetary value of that output (nominal GDP in US dollars) can surge dramatically if the local currency depreciates sharply or if inflation is rampant. Therefore, while these nominal growth percentages reflect significant monetary expansion, they do not necessarily translate directly into improved living standards or a proportional increase in real economic activity for the average Iranian. This distinction is vital for a nuanced understanding of Iran's economic performance.Factors Influencing Iran's Nominal GDP

Iran's nominal GDP, particularly the figures for 2024, is shaped by a complex interplay of internal and external factors. Understanding these influences is key to grasping the nuances of the country's economic performance and its future prospects. One of the most significant factors is **oil revenues and global prices**. As a major oil producer, Iran's economy remains heavily reliant on crude oil exports. Fluctuations in international oil prices directly impact the country's foreign exchange earnings, government revenues, and overall economic activity. Higher oil prices can boost nominal GDP, especially when calculated in US dollars, as it increases the dollar value of exports. Conversely, a drop in prices can lead to economic contraction. **International sanctions** represent another paramount influence. Decades of various forms of sanctions, particularly those imposed by the United States, have severely restricted Iran's access to global financial markets, limited its ability to sell oil, and deterred foreign investment. These sanctions force Iran to rely more on domestic production and trade with a limited number of partners, impacting its potential for higher GDP growth. Any changes in the sanctions regime, whether tightening or easing, can have immediate and profound effects on Iran's economic outlook and its nominal GDP. **Domestic economic policies and reforms** also play a crucial role. The Iranian government's approach to fiscal policy, monetary policy, and structural reforms directly influences the business environment, inflation rates, and the overall productivity of the economy. Policies aimed at diversifying the economy away from oil, supporting non-oil exports, and improving the ease of doing business can contribute to sustainable GDP growth. Furthermore, **inflation and currency fluctuations** have a direct and often dramatic impact on nominal GDP, especially when converted to US dollars. As noted earlier, high domestic inflation can inflate nominal GDP figures in local currency, and a significant depreciation of the Iranian Rial against the US dollar can either boost or depress the dollar-denominated nominal GDP depending on the exact dynamics of conversion and the underlying real economic activity. This volatility makes nominal GDP a less reliable indicator of real economic health than real GDP, which adjusts for price changes. Finally, **geopolitical developments** in the broader Middle East and globally can also affect Iran's economic stability. Regional tensions, conflicts, and shifts in international alliances can impact trade routes, investment flows, and overall economic confidence, thereby influencing Iran's ability to achieve higher nominal GDP figures.The Significance of GDP Per Capita in Iran

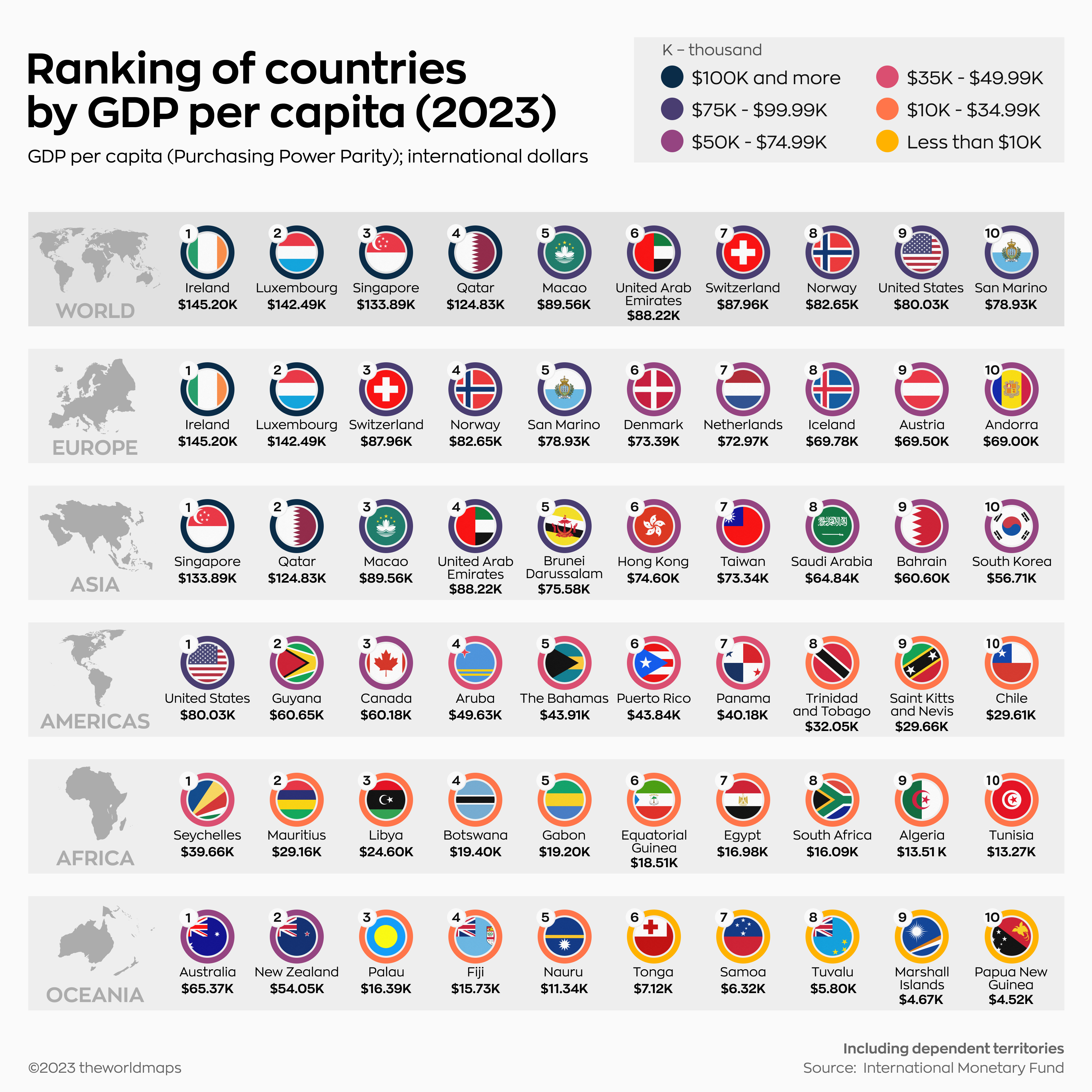

While the overall nominal GDP provides a measure of a country's economic size, GDP per capita offers a more nuanced understanding of the average economic output per person. It is calculated by dividing the total GDP by the country's population, giving an indication of the standard of living and economic well-being within a nation. For Iran, the GDP per capita figures highlight both progress and ongoing challenges. In 2024, Iran's GDP per capita was estimated at **USD 4,633**. This figure, when compared to the global average of **USD 10,589**, indicates that Iran's per capita economic output is significantly below the worldwide average. This gap underscores the economic challenges faced by the country, particularly in translating its considerable natural resources and industrial base into widespread prosperity for its citizens. The implications of a lower GDP per capita are far-reaching. It often correlates with lower average incomes, reduced access to quality healthcare and education, and fewer opportunities for individual economic advancement. For Iran, improving GDP per capita is a critical objective, as it directly impacts the quality of life for its population. Achieving this requires not just overall economic growth but also ensuring that this growth is inclusive and benefits a broad segment of society. Challenges in improving per capita income in Iran stem from several factors, including population growth, high inflation eroding purchasing power, and the uneven distribution of wealth. Sanctions also play a role by limiting foreign investment and technological transfer, which are crucial for boosting productivity and creating high-value jobs. Diversifying the economy, fostering innovation, and implementing policies that promote equitable wealth distribution are essential steps for Iran to narrow the gap between its GDP per capita and the global average, ultimately leading to improved living standards for its citizens.What Do These Figures Mean for the Average Iranian?

While macro-economic figures like nominal GDP and GDP per capita provide a broad overview of a nation's economic health, their real significance lies in how they translate to the daily lives of ordinary citizens. For the average Iranian, the nominal GDP of USD 436.91 billion in 2024 and a GDP per capita of USD 4,633 paint a complex picture of resilience amidst ongoing economic pressures. One of the most critical factors impacting the average Iranian is **inflation**. As discussed earlier, high nominal GDP growth rates in US dollar terms (like the 35.070% reported for March 2024) can often be a symptom of significant domestic inflation and currency depreciation. While the overall economic output might be increasing in monetary terms, the purchasing power of the local currency can be severely eroded. This means that even if the economy is growing, the cost of living—food, housing, transportation, and other essentials—might be rising even faster, making it challenging for households to maintain their living standards. This phenomenon, often referred to as "stagflation" or "inflated growth," means that the economic gains seen at the national level do not always translate into tangible improvements for individuals. Furthermore, **employment and income distribution** are crucial. A growing GDP is meaningful only if it leads to job creation and equitable income distribution. If economic growth is concentrated in specific sectors or benefits only a small segment of the population, the majority might not experience an improvement in their quality of life. The challenge for Iran is to ensure that its economic expansion translates into stable, well-paying jobs across various sectors and that the benefits of growth are shared more broadly among its citizens. The impact of **sanctions** also directly affects the average Iranian. These restrictions limit access to international markets, technology, and financial services, which can hinder the growth of small and medium-sized enterprises (SMEs) and limit opportunities for innovation. This, in turn, can affect job availability and the overall dynamism of the private sector, which is often the primary engine of job creation. For consumers, sanctions can lead to higher prices for imported goods and a limited variety of products. In essence, while the 2024 nominal GDP figures show an economy that is expanding, the true measure of its success for the average Iranian will depend on how effectively the government can control inflation, create sustainable employment opportunities, and ensure that economic growth translates into tangible improvements in daily living standards and purchasing power.Projections and Future Outlook for Iran's Economy

Looking beyond the current 2024 nominal GDP figures, the future outlook for Iran's economy remains a subject of considerable interest and varying projections from international bodies like the IMF and World Bank. These institutions continuously monitor global economies, offering forecasts that consider a multitude of factors, from internal policies to geopolitical shifts. The **International Monetary Fund (IMF)**, through its International Financial Statistics (IFS) release, provides nominal gross domestic product data for Iran, including both historical figures and forecasts. Similarly, the World Bank regularly updates its data, exploring Iran's GDP data in current US dollars and providing estimates that stretch back decades. These projections often take into account expected oil prices, the potential impact of sanctions, domestic economic reforms, and regional stability. One of the primary challenges for Iran's future economic growth is its continued reliance on oil revenues. While efforts are being made to diversify the economy, the pace of this diversification and its effectiveness in generating sustainable, non-oil growth will be critical. Investing in sectors like tourism, information technology, and advanced manufacturing could unlock new avenues for economic expansion and reduce vulnerability to oil price fluctuations and sanctions. The potential for **diversification** is immense, given Iran's vast natural resources beyond oil and gas, its relatively young and educated population, and its strategic geographical location. However, realizing this potential requires significant structural reforms, improved governance, and a more predictable economic environment to attract both domestic and foreign investment. Furthermore, the future of **international sanctions** remains a key determinant of Iran's economic trajectory. Any significant change in the sanctions regime could either accelerate economic recovery and integration into the global economy or, conversely, lead to further isolation and economic hardship. The political climate, both domestically and internationally, will therefore play a crucial role in shaping Iran's economic future. In summary, while the 2024 nominal GDP figures indicate a growing economy, the path forward for Iran is fraught with challenges. The ability of the government to implement effective economic policies, manage inflation, foster diversification, and navigate complex geopolitical dynamics will ultimately determine the long-term health and prosperity of the Iranian economy.Navigating Economic Data: Why Sources Matter

In an age of information overload, understanding where economic data comes from and how to interpret it is paramount, especially when discussing figures like Iran's nominal GDP for 2024. The credibility of the source directly impacts the trustworthiness and reliability of the information. For economic data, institutions like the World Bank and the International Monetary Fund (IMF) are considered gold standards. The **World Bank** provides comprehensive data on Iran's GDP, including nominal and PPP terms, stretching back to 1960 for nominal figures and 1990 for PPP figures. Their data is often cited as "official data" and is meticulously collected and analyzed, making it a highly reliable

Countries by nominal GDP (2024) - Learner trip

Iran real GDP growth rate, nominal GDP, GDP PPP, GDP per capita

Gdp 2024 Usa - Nita Terese