Mastering Transaction Support: Navigate Deals With Confidence

In the dynamic world of business, strategic transactions like mergers, acquisitions, and divestitures are often pivotal moments that can redefine an organization's future. These high-stakes endeavors are far from simple; they are intricate processes fraught with complexities, requiring meticulous planning, rigorous analysis, and expert guidance. This is precisely where comprehensive transaction support becomes not just beneficial, but absolutely indispensable for success. Without robust support, even the most promising deals can falter, leading to missed opportunities, unforeseen liabilities, and significant financial setbacks.

Navigating these critical stages requires more than just good intentions; it demands a clear understanding of objectives, a keen eye for identifying potential risks, and seamless coordination of essential due diligence. Whether you're a buyer, a seller, an investor, or a lender, the ability to fully assess the risk of a transaction and complete deals on time and with confidence hinges on having the right expertise by your side. This article will delve deep into the multifaceted world of transaction support, exploring its critical components, its role throughout the deal lifecycle, and why it's the bedrock of successful strategic business transformations.

Table of Contents

- Understanding Transaction Support: More Than Just a Buzzword

- The Cornerstone: Comprehensive Due Diligence

- Navigating the Deal Lifecycle: A Phased Approach

- Mitigating Risks and Maximizing Value

- Strategic Insight: Forecasting, Analysis, and Market Expertise

- Beyond Mergers: Transaction Support in Broader Business Operations

- The Human Element: Why Expert Guidance Matters

- Choosing Your Transaction Support Partner: What to Look For

- Conclusion: Your Path to Confident Transactions

Understanding Transaction Support: More Than Just a Buzzword

At its core, transaction support refers to the specialized services and expertise provided to organizations as they engage in significant strategic transactions. This isn't merely administrative assistance; it's a holistic approach designed to guide clients through every critical stage of a deal. From the initial strategic planning to post-deal integration, transaction support aims to equip businesses with the clarity, structure, and insights necessary to complete deals successfully, on time, and with utmost confidence. It’s about more than just closing a deal; it’s about ensuring the deal aligns with your long-term goals and delivers the expected value. The scope of these services is broad, encompassing everything from financial and tax advisory to operational and IT due diligence. Firms like Wg Consulting and Pyek Financial emphasize their role in helping clients define clear objectives, identify potential risks, and coordinate the complex web of activities involved. This comprehensive, integrated approach is vital because every aspect of a transaction, from the numbers on a balance sheet to the efficiency of IT systems, can impact the overall success and value creation. In essence, transaction support acts as your strategic partner, helping you navigate the often-turbulent waters of business transformation.The Cornerstone: Comprehensive Due Diligence

Perhaps the most critical component of effective transaction support is comprehensive due diligence. This is a precautionary and investigative process that significantly reduces transaction risk. It involves collecting and meticulously analyzing all material facts of the other party in a business transaction. Think of it as a deep dive into the target company's past, present, and future potential. This thorough examination enables buyers, investors, lenders, partners, and other potential stakeholders to fully assess the risks and opportunities associated with a transaction. Without it, you're essentially making a high-stakes decision in the dark, relying on assumptions rather than verified facts. Due diligence isn't a one-size-fits-all process; it spans multiple critical areas, each requiring specialized expertise. The goal is to uncover any red flags, hidden liabilities, or operational inefficiencies that could impact the deal's value or future success. By understanding these critical risks upfront, clients can either mitigate them, adjust the deal terms, or, if necessary, walk away from a potentially disastrous agreement. This proactive risk assessment is what truly sets professional transaction support apart.Financial Due Diligence: Unveiling the Numbers

Financial due diligence is often the starting point, focusing on the target company's financial health and performance. This involves a rigorous examination of financial statements, revenue streams, cost structures, assets, liabilities, and cash flow. Experts delve into historical financial data, analyze projections, and scrutinize accounting practices to ensure accuracy and identify any irregularities or aggressive accounting policies. The aim is to validate the reported financial performance, understand the true earnings potential, and identify any hidden debts or contingent liabilities that might not be immediately apparent. Beyond just verifying numbers, financial due diligence also involves understanding the quality of earnings, working capital requirements, and tax implications. For instance, services often include comprehensive tax diligence to understand the tax position of the target, potential tax exposures, and opportunities for tax optimization post-acquisition. This detailed financial scrutiny provides a realistic picture of the target's financial standing, forming the basis for valuation and deal structuring.Operational and IT Due Diligence: Beyond the Balance Sheet

While financial due diligence provides the monetary picture, operational and IT due diligence reveal the underlying health and efficiency of the business itself. Operational due diligence assesses the target's core business processes, supply chain, production capabilities, sales and marketing functions, and human resources. It seeks to understand how the business actually runs, identifying areas of synergy, potential bottlenecks, or integration challenges. For example, understanding the post-separation target's operational capabilities and identifying divestiture transition costs are crucial for successful integration or separation. IT due diligence, on the other hand, evaluates the target's technology infrastructure, systems, software, cybersecurity posture, and data management practices. In today's digital age, a robust and secure IT environment is paramount. Assessing the compatibility of IT systems, potential integration costs, and cybersecurity risks is vital to avoid costly post-acquisition surprises. PWC teams, for instance, emphasize executing financial and operational due diligence with a focus on value creation levers, transition planning, and integration/separation issues, highlighting the interconnectedness of these diligence areas. This holistic view ensures that all facets of the business are scrutinized, providing a complete picture of potential risks and opportunities.Navigating the Deal Lifecycle: A Phased Approach

Successful strategic transactions rarely happen overnight; they unfold across distinct phases, each with its unique challenges and requirements. Effective transaction support is designed to assist clients throughout all these phases, from the very inception of an idea to the long-term integration or separation. This "start to finish and beyond" approach ensures continuity, consistency, and expert guidance at every turn. The deal lifecycle typically begins with strategy and target identification, where objectives are defined and potential opportunities are assessed. This is followed by the crucial due diligence phase, where risks are identified and analyzed. Next comes negotiation and structuring, where the deal terms are finalized, and legal frameworks are established. Finally, the deal closes, leading to post-merger integration (PMI) or separation, which is often as complex as the deal itself. Firms like Fahrenheit emphasize supporting critical transaction phases, including forecasting and analysis, financial scorecards, and market expertise, ensuring that clients maximize the deal's value. The flexibility to customize transaction support services to suit needs at different stages of M&A is a hallmark of truly valuable partnerships.Mitigating Risks and Maximizing Value

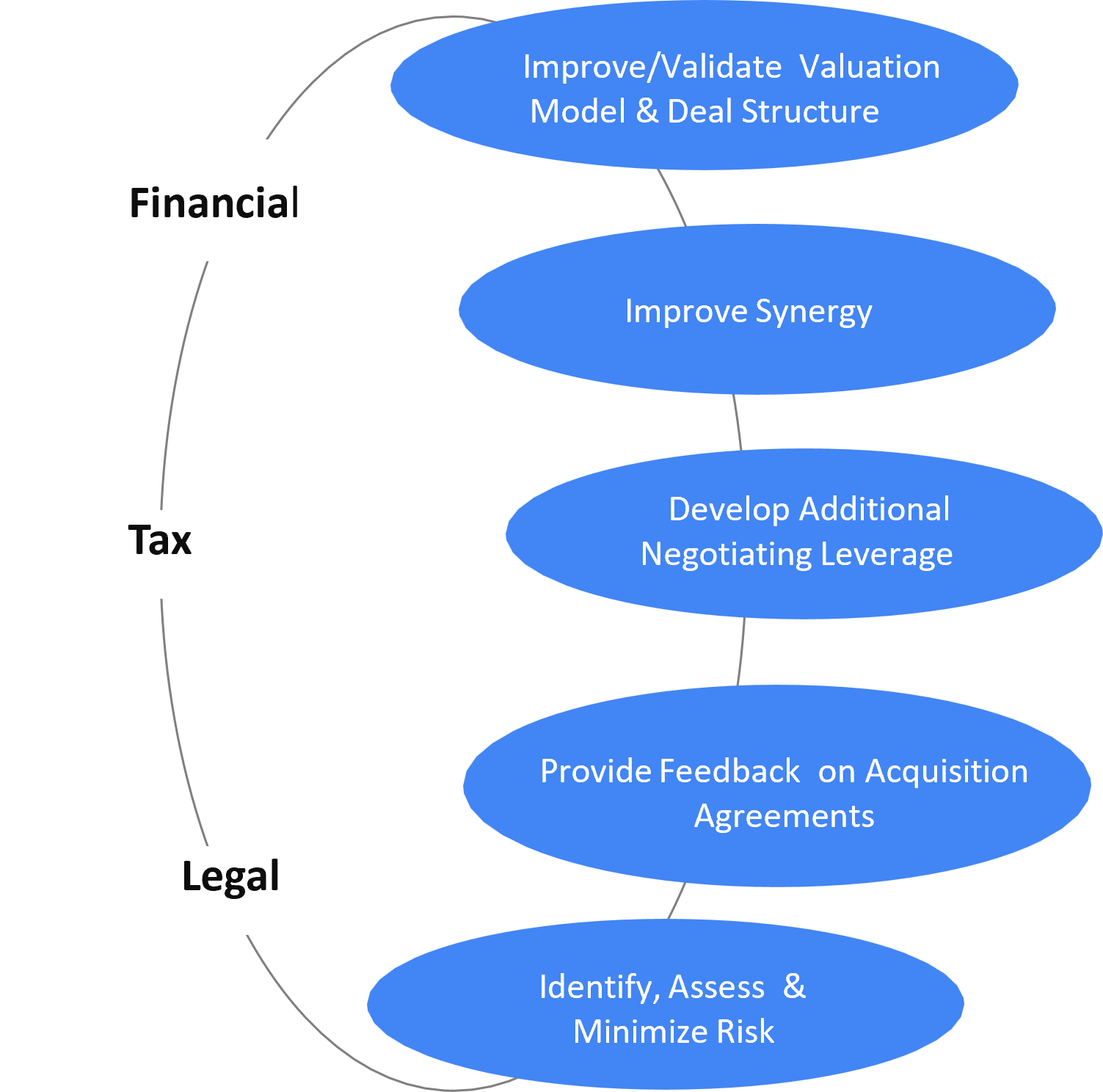

The primary goal of robust transaction support is twofold: to mitigate risks and to maximize the deal's value. Risks in transactions can range from financial misrepresentations and legal liabilities to operational inefficiencies and cultural clashes. By conducting thorough due diligence and providing expert advisory, transaction support teams help clients understand and overcome these critical risks. They identify potential pitfalls early on, allowing for strategic adjustments or renegotiations that protect the client's interests. Beyond risk mitigation, transaction support also focuses on value creation. This involves identifying synergies, optimizing deal structures, and developing robust post-deal integration plans. For instance, experts help clients structure deals that align with their strategic goals, ensuring that the acquired or merged entity contributes positively to the overall business objectives. This might involve optimizing financing structures, identifying cost efficiencies, or leveraging market expertise to unlock new growth opportunities. The ultimate aim is to ensure that the transaction not only closes but also delivers on its promise of long-term value for all stakeholders.Strategic Insight: Forecasting, Analysis, and Market Expertise

In the complex landscape of M&A, simply reacting to opportunities isn't enough. Proactive strategic insight, powered by robust forecasting, detailed analysis, and deep market expertise, is crucial for identifying opportunities and structuring deals that truly align with an organization's long-term goals. This is another area where transaction support shines. Experts leverage their extensive market knowledge and analytical capabilities to provide clients with a clear understanding of market trends, competitive landscapes, and potential growth areas. They develop financial scorecards and conduct detailed forecasting to project future performance, assess potential synergies, and model various deal scenarios. This foresight allows clients to make informed decisions, identify the most promising opportunities, and negotiate from a position of strength. Whether it's assessing the fair value of a target, understanding the implications of market shifts, or predicting post-merger performance, strategic insight is the compass that guides successful transactions.Beyond Mergers: Transaction Support in Broader Business Operations

While much of the discussion around transaction support often centers on mergers and acquisitions, it's important to recognize that the concept of "transaction" extends far beyond the realm of M&A. In a broader sense, a transaction can refer to any discrete unit of work that involves changes to data or processes, requiring atomicity and reliability. This includes operations within database systems and the day-to-day processes of businesses.Transaction Management in Database Systems

In a database management system (DBMS), a transaction is defined as a sequence of operations performed as a single logical unit of work. These operations might involve reading, writing, updating, or deleting data. The critical characteristic here is atomicity: a transaction is considered complete only if all its operations are successfully executed; otherwise, the entire transaction must be rolled back, ensuring the database remains in a consistent state. This concept is fundamental to data integrity and reliability. Modern databases like MongoDB support distributed transactions, even across replica sets and sharded clusters, ensuring that data changes either apply all at once or are entirely rolled back. This is crucial for applications requiring high consistency, such as financial systems where a transfer of funds must either complete fully or not at all. Furthermore, programming frameworks like Spring provide tools like `TransactionTemplate` for programmatic transaction management, simplifying the control of transactions within applications by allowing developers to define propagation behaviors and isolation levels. This technical form of transaction support ensures data consistency and reliability in software applications.Transaction Support in Daily Business Operations

Beyond the technical definition, "transaction support" also refers to the operational assistance provided to facilitate routine business operations. This can include support for front-end customer interactions, image and data capture, payment services, and document management. For example, platforms like Square offer community support and help resources for sellers navigating payment processing and transaction queries. Similarly, app stores provide support for buying and paying for apps, music, movies, and books. In this context, transaction support programs are often tailored for buyers and sellers who have already found each other and need assistance in completing their day-to-day transactions efficiently and securely. It's about streamlining processes, ensuring accuracy, and providing immediate assistance for common transaction-related issues. This broader view of transaction support emphasizes its role in enabling smooth, reliable business interactions on a daily basis, underpinning the efficiency of commerce.The Human Element: Why Expert Guidance Matters

While technology and robust methodologies are crucial, the human element in transaction support remains irreplaceable. Mergers, acquisitions, and other strategic transactions are not just about numbers and legal documents; they are about people, cultures, and strategic visions. The nuanced understanding of market dynamics, the ability to anticipate challenges, and the skill to negotiate complex terms require seasoned professionals. Expert transaction advisors bring years of experience, having navigated countless deals across various industries. They offer objective insights, identify blind spots, and provide a steady hand through what can often be an emotional and high-pressure process. Their global reach, as exemplified by firms with teams based in multiple locations, means they can provide specialist support in critical areas, leveraging diverse perspectives and local market knowledge. This personalized, expert guidance is what truly empowers clients to navigate critical transactions confidently, maximizing deal value and minimizing unforeseen complications.Choosing Your Transaction Support Partner: What to Look For

Selecting the right transaction support partner is a decision that can significantly impact the outcome of your strategic endeavors. With so much at stake, it’s essential to choose a firm that aligns with your specific needs and offers comprehensive capabilities. Here are key factors to consider: * **Breadth of Services:** Look for partners who offer integrated services spanning financial, tax, IT, and operational due diligence, as well as post-deal integration support. A holistic approach ensures no critical area is overlooked. * **Experience and Expertise:** Assess their track record. Do they have extensive experience in your industry or with similar transaction types? Do their experts possess deep financial acumen, strategic insight, and market expertise? * **Global Reach (if applicable):** If your transaction involves international parties or assets, a partner with a global footprint and local market knowledge can be invaluable. * **Customization and Flexibility:** The best partners don't offer a rigid, one-size-fits-all solution. They should be flexible enough to customize their services to suit your unique needs at different stages of the M&A process. * **Value-Added Approach:** Beyond just identifying risks, a strong partner will focus on value creation, helping you identify opportunities and structure deals that truly align with your goals. * **Communication and Trust:** A successful partnership is built on clear communication and mutual trust. Choose a team that is transparent, responsive, and easy to work with. By carefully evaluating these aspects, you can secure a partner who will truly be "with you from start to finish and beyond," ensuring your transformative steps are taken with thorough due diligence, strategic insight, and financial acumen.Conclusion: Your Path to Confident Transactions

In conclusion, whether you are embarking on a transformative acquisition, navigating a complex merger, or divesting a business unit, the journey is fraught with challenges and opportunities. Comprehensive transaction support is the guiding hand that empowers organizations to navigate these critical stages with clarity, structure, and confidence. From meticulous due diligence that uncovers hidden risks to strategic insights that maximize value, and from expert coordination throughout the deal lifecycle to specialized support for broader business operations, these services are designed to ensure success. The insights provided by seasoned professionals, coupled with robust analytical tools, are invaluable in defining clear objectives, assessing risks, and structuring deals that align perfectly with your strategic goals. Don't leave your organization's future to chance. Embrace the power of expert transaction support to transform potential pitfalls into pathways for growth and prosperity. What are your experiences with strategic transactions? Share your thoughts in the comments below, or explore more of our articles on business strategy and financial acumen to further empower your organization's journey.- Esli Monkey App Leak

- Iran National Volleyball Team

- Noah Grey Cabey

- A J Cook Actress

- Hayley Williams Paramore Lead Singer

Transaction Support Team

Transaction Support

Transaction Support Team - Home