Development Banks: Powering Global Progress & Stability

Table of Contents

- What Are Development Banks?

- Differentiating from Commercial Banks

- Main Features and Functions

- The Global Impact of Development Banks

- National Development Banks (NDBs)

- Multilateral Development Banks (MDBs)

- Development Banks in Action: Case Studies

- Interaction with Private Sector and Government Policies

- The Future Role and Importance

What Are Development Banks?

At its core, a **development bank** is a financial institution established to provide long-term financing for projects that promote economic and social development. Unlike conventional commercial banks that primarily focus on short-term profitability and liquidity, development banks prioritize sustainable growth and poverty reduction. They are crucial for economic development, filling financing gaps where commercial lenders may be unwilling or unable to provide capital due to the high risk, long gestation periods, or low immediate returns associated with development projects. These institutions play a unique role by investing in areas that foster broader societal benefits, such as infrastructure (roads, energy, water), education, healthcare, agriculture, and small and medium-sized enterprises (SMEs). Their importance stems from their ability to mobilize significant capital, often from international sources or government contributions, and direct it towards strategic sectors that underpin a nation's long-term prosperity. They are not merely lenders; they are partners in progress, offering technical assistance, policy advice, and capacity building to ensure projects are not only funded but also successfully implemented and sustained.Differentiating from Commercial Banks

Understanding the distinction between a development bank and a commercial bank is fundamental to appreciating their respective roles in the financial ecosystem. While both are financial institutions, their objectives, operational models, and risk appetites diverge significantly. A commercial bank operates primarily to generate profit for its shareholders through a wide range of services, including accepting deposits, offering loans, and facilitating transactions for individuals and businesses. Their lending decisions are typically driven by creditworthiness, collateral, and the potential for quick returns, often focusing on short-to-medium term financing. They are regulated to maintain high liquidity and manage risk to protect depositors' funds. In contrast, a development bank's primary objective is not profit maximization but rather to foster economic and social development. They undertake projects that may not be commercially viable in the short term but are essential for long-term national or regional growth. Their financing often involves higher risks, longer repayment periods, and lower interest rates than commercial loans. "Learn what a development bank is, how it differs from a commercial bank, and why it is important for economic development" involves recognizing that development banks often operate with a broader mandate, focusing on market failures, social impact, and strategic national priorities rather than just financial returns. They are patient capital providers, willing to invest in projects that can take decades to yield full benefits, such as large-scale infrastructure or nascent industries.Main Features and Functions

Development banks are characterized by a set of distinct features and functions that enable them to fulfill their unique mandate. These institutions are designed to address market imperfections and provide financing for projects that are crucial for sustainable development but might otherwise struggle to attract funding. "Learn about the main features, functions and projects of the world's largest development banks, both national and multilateral," reveals a common thread of strategic, long-term investment.Financing Mechanisms

The financing offered by development banks is diverse and tailored to the specific needs of development projects. "It assists its members and partners by providing loans, technical assistance, grants, and equity investments to promote social and economic development." This multi-faceted approach allows them to support a wide array of initiatives, from large-scale infrastructure to capacity-building programs. * **Loans:** These are the most common form of financing, often provided at concessional rates (below market rates) or with very long repayment periods. The terms (share equity or loans) and cost of financing offered by development banks depend on their cost of obtaining capital and their need to show a profit and pay dividends. While profitability is not their primary goal, they must ensure financial sustainability to continue their operations. * **Technical Assistance:** Beyond mere funding, development banks offer expertise and guidance to help countries design, implement, and manage projects effectively. This can include feasibility studies, policy advice, and training. * **Grants:** For projects with significant social or environmental benefits that may not generate direct financial returns, grants are provided. These are non-repayable funds, typically for initiatives like public health campaigns, disaster relief, or environmental conservation. * **Equity Investments:** Development banks can also take equity stakes in companies or projects, particularly in nascent industries or those with high development impact. This provides capital without adding to a country's debt burden and aligns the bank's interests with the project's long-term success.Ownership and Operation

The ownership structure of development banks can vary, influencing their operational dynamics and funding sources. "Development banks may be publicly or privately owned and operated, although governments frequently make substantial contributions to the capital of private banks." * **Public Ownership:** Many development banks are publicly owned, either by national governments (national development banks) or by a consortium of member countries (multilateral development banks). This public ownership ensures alignment with national or international development agendas and allows them to mobilize significant capital through government contributions or by issuing bonds in capital markets, often backed by sovereign guarantees. * **Private Contributions:** While less common for the core capital, private sector participation can occur, especially in the form of co-financing or specialized funds managed by development banks. Even in privately operated development banks, government contributions are often substantial, highlighting the public interest in their mandate. * **Operational Focus:** "Find out how they operate, what functions they perform, and how they interact with the private sector and government policies." Development banks typically operate with a long-term perspective, focusing on strategic sectors and projects that contribute to sustainable development. They engage in rigorous project appraisal, monitoring, and evaluation to ensure effectiveness and accountability. Their interaction with government policies is crucial, as they often support national development plans and policy reforms.The Global Impact of Development Banks

The influence of development banks extends far beyond mere financial transactions. "Discover how these institutions influence global infrastructure, economy and sustainability through their investments and partnerships." They are pivotal in shaping the developmental trajectory of nations and regions, acting as catalysts for transformative change. * **Infrastructure Development:** From building critical transportation networks and energy grids to establishing water and sanitation systems, development banks are primary financiers of large-scale infrastructure projects. These projects are the backbone of economic activity, enabling trade, improving access to services, and enhancing productivity. * **Economic Growth:** By providing capital for key sectors like agriculture, industry, and services, development banks stimulate economic activity, create jobs, and foster innovation. "Learn how NDBs support economic growth, innovation, and sustainability in various countries." Their investments often lead to multiplier effects, spurring further private sector investment and broader economic expansion. * **Sustainability and Resilience:** In an era of climate change and environmental degradation, development banks are increasingly focusing on green investments. They finance renewable energy projects, climate-resilient infrastructure, and sustainable agricultural practices, contributing significantly to global efforts to combat climate change and promote environmental stewardship. * **Social Development:** Beyond economic metrics, these banks invest in human capital through projects in education, health, and social protection. They aim to reduce poverty, improve living standards, and promote inclusivity, especially for vulnerable populations. "Public development banks are a crucial but often underappreciated force driving global change for the better." Their work directly addresses pressing social challenges, contributing to a more equitable world. "As the world confronts compounding crises, we deep dive into PDBs and why they matter for rural people," highlighting their critical role in supporting vulnerable communities, particularly in rural areas often disproportionately affected by crises.National Development Banks (NDBs)

National Development Banks (NDBs) are financial institutions established by a country's government to provide financing for its economic development. "A national development bank is a development bank created by a country's government that provides financing for the purposes of economic development of the country." Their mandate is specifically tailored to the unique development priorities and challenges of their respective nations. NDBs play a crucial role in mobilizing domestic resources, channeling them into strategic sectors, and supporting local businesses that may not have access to commercial financing. They often work closely with government policies, acting as instruments for implementing national development plans. "Learn how NDBs support economic growth, innovation, and sustainability in various countries," by focusing on areas such as: * **Industrial Development:** Providing capital for manufacturing, technology, and other key industries. * **Agricultural Support:** Financing for farmers, agricultural infrastructure, and food security initiatives. * **SME Development:** Offering loans, guarantees, and technical assistance to small and medium-sized enterprises, which are often the backbone of job creation and economic diversification. * **Regional Development:** Addressing disparities by investing in underdeveloped regions within a country. Many countries have robust NDB systems. For instance, in Nepal, "There are 16 development banks operating in Nepal under the guidelines of Nepal Rastra Bank (NRB)." These institutions are categorized as "class ‘B’ financial institutions in Nepal," indicating their distinct regulatory framework under the central bank. "Nepal Rastra Bank (NRB) regulates all the banks and financial institutions (BFIs) of Nepal," ensuring their stability and adherence to development objectives. Another example is the "Access to Capital for Entrepreneurs (ACT!)" in the United States, which "is a community development financial institution (CDFI) serving Georgia, mainly Southwest Georgia, that provides access to capital and business development services." ACT! "was created in 1997 with seed capital from the City of Albany and four local banks," demonstrating how NDB-like functions can emerge from local partnerships to address specific community needs. The strategic importance of NDBs is undeniable, leading to the recommendation that "Countries should aim to expand the role of their national development banks, while others should consider establishing them."Multilateral Development Banks (MDBs)

Multilateral Development Banks (MDBs) are international financial institutions owned by multiple member countries. They provide financial and technical assistance to developing countries to promote economic and social development. Their global reach and substantial financial resources make them critical players in addressing cross-border development challenges, such as climate change, pandemics, and regional integration.Key Players and Their Roles

The MDB landscape is dominated by several major institutions, each with a specific regional or global focus: * **The World Bank Group:** As a unique global partnership fighting poverty worldwide through sustainable solutions, "With 189 member countries, the World Bank Group" is arguably the most prominent MDB. It provides low-interest loans, interest-free credits, and grants to developing countries for a wide array of purposes, including education, health, infrastructure, communications, and environmental protection. * **Asian Development Bank (ADB):** "The Asian Development Bank (ADB) is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty." It plays a vital role in supporting economic growth and cooperation across its vast and diverse region, providing loans, technical assistance, grants, and equity investments to its members and partners. * **Inter-American Development Bank (IDB) Group:** This group focuses on Latin America and the Caribbean. "It comprises the IDB, which works with the region’s public sector and enables the private sector," and "IDB Invest, which directly supports private companies and projects." This structure highlights a growing trend among MDBs to engage more directly with the private sector to leverage additional capital for development. Other significant MDBs include the African Development Bank (AfDB), the European Bank for Reconstruction and Development (EBRD), and the Islamic Development Bank (IsDB), among others. These institutions collectively represent a powerful force for global development.Collaborative Efforts Among MDBs

Recognizing the scale and complexity of global development challenges, MDBs are increasingly working together to maximize their impact. "The leaders of 10 multilateral development banks (MDBs) today announced joint steps to work more effectively as a system and increase the impact and scale of their work to tackle urgent development challenges." This collaboration involves sharing knowledge, co-financing projects, and harmonizing operational policies to enhance efficiency and effectiveness. This spirit of cooperation was further solidified when "The heads of 10 multilateral development banks (MDBs) welcomed today the endorsement by G20 leaders of the G20 Roadmap towards better, bigger, and more effective MDBs." This endorsement underscores the international community's recognition of MDBs' critical role and the need for them to evolve and expand their capacity to address pressing global issues like climate change, food security, and fragility. The roadmap aims to strengthen MDBs' financial capacity, operational efficiency, and responsiveness to client needs, ensuring they remain fit for purpose in a rapidly changing world.Development Banks in Action: Case Studies

To truly grasp the influence of development banks, it's essential to look at their tangible impact on the ground. "See examples of development banks around the world and their roles and objectives" reveals a mosaic of transformative projects that have reshaped economies and improved lives. Consider the **Asian Development Bank (ADB)**'s commitment to climate action. Beyond its core mission of eradicating extreme poverty, the ADB is heavily invested in promoting renewable energy, climate-resilient infrastructure, and sustainable cities across Asia and the Pacific. For instance, it has financed large-scale solar power projects in India, flood management systems in Bangladesh, and urban transport networks designed to reduce carbon emissions in Southeast Asian cities. These projects not only provide essential services but also contribute to global sustainability goals. The **World Bank Group**, with its expansive global reach, has been instrumental in supporting critical health initiatives. During global health crises, it has provided rapid financing for vaccine procurement, health system strengthening, and emergency response, demonstrating its agility and crucial role in global public goods. Beyond crisis response, its long-term investments in education in Africa, for example, aim to build human capital, improve learning outcomes, and equip future generations with the skills needed for economic participation. The **Inter-American Development Bank (IDB) Group** showcases the direct engagement with the private sector through IDB Invest. This entity directly supports private companies and projects in Latin America and the Caribbean, fostering innovation and job creation. An example might be financing for small and medium-sized enterprises (SMEs) in renewable energy or sustainable agriculture, which not only generates economic activity but also aligns with environmental objectives. At the national level, an NDB like the **Development Bank of Latin America (CAF)**, while having multilateral characteristics, often focuses on regional integration projects, such as cross-border energy infrastructure or trade corridors, that unlock economic potential for multiple countries. Similarly, the local impact of **ACT!** in Southwest Georgia, providing capital and business development services, illustrates how development finance can be tailored to community-specific needs, fostering entrepreneurship and local economic resilience. These varied examples underscore the flexible and responsive nature of development banks in addressing diverse challenges.Interaction with Private Sector and Government Policies

A key aspect of how development banks operate is their intricate interaction with both the private sector and government policies. "Find out how they operate, what functions they perform, and how they interact with the private sector and government policies." This symbiotic relationship is crucial for maximizing development impact and ensuring sustainability. Development banks often act as catalysts for private investment. By providing initial capital, technical assistance, or risk mitigation instruments (like guarantees), they can de-risk projects that would otherwise be too risky for commercial lenders. This "crowding-in" effect encourages private sector participation in critical development areas. For instance, IDB Invest, as part of the IDB Group, directly supports private companies and projects, demonstrating a direct partnership model. Similarly, many NDBs work to strengthen local financial markets, enabling domestic private banks to participate more effectively in development finance. Their interaction with government policies is equally vital. Development banks typically align their investments with national development strategies and priorities. They often provide policy advice and support institutional reforms that create a more conducive environment for investment and sustainable growth. This can involve helping governments improve regulatory frameworks, enhance public financial management, or develop sector-specific policies. By working hand-in-hand with governments, development banks ensure that their projects are not isolated initiatives but are integrated into a broader, coherent development agenda. This strategic partnership ensures that investments are impactful, sustainable, and contribute to long-term national objectives.The Future Role and Importance

In a world grappling with unprecedented challenges—from climate change and pandemics to persistent inequalities and geopolitical instability—the role of development banks is more critical than ever. "Public development banks are a crucial but often underappreciated force driving global change for the better," and their capacity to mobilize resources and expertise makes them indispensable in addressing these compounding crises. Their future importance lies in their ability to: * **Mobilize greater capital:** The scale of global development needs far outstrips current financing. Development banks are uniquely positioned to leverage their balance sheets, attract private capital, and innovate financing mechanisms to bridge this gap. The G20 Roadmap towards better, bigger, and more effective MDBs signifies a global commitment to enhancing their financial firepower. * **Lead on climate action:** As the primary financiers of green infrastructure and climate adaptation, development banks will continue to be at the forefront of the global transition to a sustainable economy. Their technical expertise and long-term investment horizon are essential for pioneering climate-resilient development. * **Foster inclusive growth:** Addressing inequalities and ensuring that development benefits reach the most vulnerable populations, especially "rural people," will remain a core mandate. This includes supporting social safety nets, enhancing access to essential services, and promoting equitable economic opportunities. * **Strengthen national capacities:** By continuing to provide technical assistance and policy advice, development banks empower countries to build stronger institutions, improve governance, and manage their own development trajectories more effectively. This is particularly relevant as "Countries should aim to expand the role of their national development banks, while others should consider establishing them," fostering greater self-reliance and tailored solutions. The evolution of development banks, from traditional lenders to comprehensive development partners, underscores their adaptability and enduring relevance. Their unique blend of financial capacity, technical expertise, and commitment to long-term societal good positions them as indispensable pillars of global progress and stability in the decades to come.Conclusion

Development banks, whether operating on a national or multilateral scale, are far more than just financial institutions; they are strategic partners in the pursuit of global progress. As we've explored, these institutions differ fundamentally from commercial banks, prioritizing long-term economic development, social upliftment, and environmental sustainability over short-term profits. Through diverse financing mechanisms—including loans, technical assistance, grants, and equity investments—they tackle complex challenges, influence global infrastructure, economy, and sustainability, and fill critical financing gaps. From the World Bank and the Asian Development Bank driving transformative projects on a global scale, to national development banks like those in Nepal or community-focused initiatives like ACT! in Georgia, their collective impact is profound. They work hand-in-hand with governments and increasingly with the private sector, catalyzing investment and shaping policies to foster resilient and inclusive growth. In a world facing compounding crises, the role of development banks is not just important, but absolutely crucial, serving as an often-underappreciated force for positive change. We hope this deep dive has illuminated the vital work of these institutions and their indispensable contribution to a more prosperous and equitable future. What are your thoughts on the role of development banks in your region or globally? Share your insights in the comments below, and consider exploring other articles on our site to learn more about the institutions shaping our world.- Meryl Streep Children

- %C3%B6zge Ya%C4%9F%C4%B1z

- What Religion Is David Jeremiah

- Of Music And Dramatic Art

- Iran Population Latest Statistics

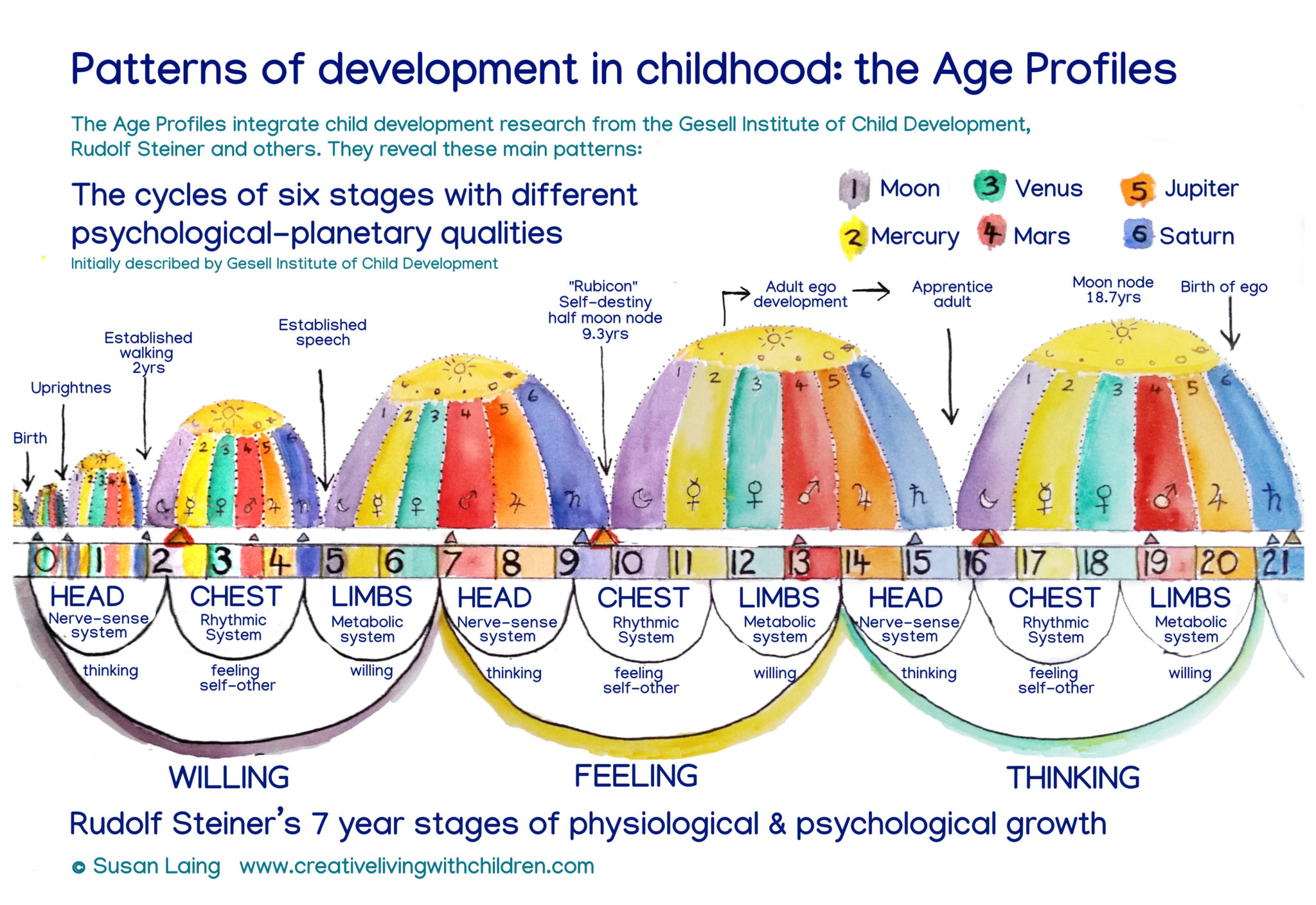

Patterns in development – Conscious Creative Courageous Living with

Product Development Process in 5 Steps | Scalefocus

Chapter 1: Intro to Lifespan Development – Human Growth and Development