BVM Mozambique: Catalyzing Economic Growth & Investment In Africa

The Mozambique Stock Exchange, known as the Bolsa de Valores de Moçambique (BVM), stands as a vibrant and increasingly pivotal financial hub in Southern Africa. It's not merely a marketplace for securities; it's a strategic engine driving capital market development and fostering economic growth within the nation. As Mozambique navigates its economic landscape, the BVM emerges as a beacon of confidence, aiming to significantly bolster the real economy through ambitious targets and a forward-thinking strategic plan.

This article delves into the transformative journey and ambitious vision of the BVM, exploring its critical role in attracting investment, enhancing the business environment, and contributing to Mozambique's long-term prosperity. From its strategic objectives to its operational framework, we uncover how the BVM is positioning itself as a central platform for successful investments and a key player in the country's financial future.

Table of Contents

- The Mozambique Stock Exchange (BVM): A Pillar of Economic Growth

- Ambitious Horizons: BVM's 2028 Strategic Vision

- Navigating Challenges and Building Confidence

- The Transformative Journey: From Public to Private Entity

- BVM's Services and Offerings: Empowering Investors and Businesses

- BVM's Rising Profile: Recognition on the African Stage

- Investing in Mozambique's Future: The BVM Opportunity

- Contact and Further Information

The Mozambique Stock Exchange (BVM): A Pillar of Economic Growth

The Bolsa de Valores de Moçambique (BVM), as it is officially known, serves as the cornerstone of Mozambique's capital markets. Established as the country's official stock exchange, its fundamental objective is to organize, manage, and maintain a central market for securities within the nation. This core function positions the BVM as a crucial institution for economic development, providing a regulated and transparent platform where companies can raise capital and investors can trade various financial instruments. It is more than just a trading floor; it is an institution dedicated to fostering financial stability and growth by connecting capital with opportunity. The BVM has consistently demonstrated its commitment to this role, evolving to meet the demands of a dynamic global economy while addressing the specific needs of the Mozambican context. Its existence signifies a commitment to modern financial practices and an open, market-driven approach to economic progress. Through its operations, the BVM plays a vital part in mobilizing domestic savings and attracting foreign investment, channeling these funds into productive sectors of the economy. This contributes directly to job creation, infrastructure development, and overall national prosperity.Ambitious Horizons: BVM's 2028 Strategic Vision

The Mozambique Stock Exchange (BVM) has laid out an ambitious strategic plan for 2028, signaling a clear intent to significantly scale its operations and impact on the national economy. These forward-looking goals are not just numerical targets; they represent a deep commitment to transforming Mozambique's financial landscape and bolstering its real economy. The BVM aims to practically double the number of listed companies, targeting an impressive 30 by 2028. This expansion is designed to broaden the investment opportunities available on the exchange and provide more Mozambican businesses with access to capital markets. Beyond the increase in listed entities, the BVM also seeks to achieve a market capitalization equivalent to 35% of Mozambique's Gross Domestic Product (GDP) by the same year. This target is particularly significant as it directly links the growth of the stock exchange to the overall economic output of the country, illustrating the BVM's ambition to be a substantial contributor to national wealth. These aspirations underscore the BVM's role as a proactive force in the nation's economic development, moving beyond mere facilitation to active catalysis.Doubling Listed Companies: A Growth Catalyst

The objective of reaching 30 listed companies by 2028 is a bold statement about the BVM's growth trajectory and its commitment to fostering a vibrant corporate sector. Currently, with a smaller number of listed entities, doubling this figure would signify a substantial increase in the diversity and depth of the market. For companies, listing on the BVM provides a powerful avenue for capital raising, enabling expansion, innovation, and job creation. It also enhances corporate governance and transparency, which are crucial for attracting both domestic and international investors. From an investor's perspective, more listed companies mean a broader range of investment choices across various sectors of the Mozambican economy. This diversification can lead to more robust portfolios and potentially higher returns, as investors can tap into different growth stories within the country. The BVM's focus on this expansion is a direct effort to make the exchange a more representative reflection of Mozambique's economic potential, encouraging more businesses to leverage the benefits of public listing.Market Capitalization as a GDP Driver

The target of achieving a market capitalization equivalent to 35% of Mozambique's GDP by 2028 is perhaps the most impactful of the BVM's strategic goals. Market capitalization is a direct measure of the total value of all listed companies, and its proportion to GDP indicates the stock market's significance within the national economy. A higher ratio suggests a more developed and influential capital market that plays a substantial role in economic activity. By aiming for 35% of GDP, the BVM is not just growing itself; it is actively seeking to boost the real economy. A larger, more liquid stock market can facilitate more efficient allocation of capital, reduce the cost of financing for businesses, and encourage greater investment. This, in turn, stimulates productivity, innovation, and overall economic expansion. This ambition positions the BVM as a critical instrument for channeling financial resources directly into the productive sectors that drive national growth and development.Navigating Challenges and Building Confidence

Mozambique, like many developing nations, has faced periods of economic uncertainty. These challenges can impact investor confidence and the overall economic landscape. However, even ahead of such days of uncertainty, the Mozambique Stock Exchange (BVM) has consistently aimed to be a stabilizing force and a clear signal of trust in the country's economy. The BVM's proactive stance and strategic initiatives are designed to counteract negative perceptions and project an image of resilience and opportunity. It positions itself not merely as a passive market, but as an active participant in shaping a positive economic narrative. The institution has articulated its desire to be "uma placa giratória e um centro de promoção de investimentos e negócios bem sucedidos" – a hub and a center for promoting successful investments and businesses. This vision goes beyond facilitating transactions; it encompasses actively attracting and nurturing business ventures that contribute meaningfully to the nation's prosperity. This approach is a clear indication of confidence in Mozambique's economic future and a commitment to strengthening its competitiveness on the regional and global stages.BVM's Role in Enhancing Business Environment

A key aspect of the BVM's strategy is its direct effect on improving the business environment. By providing a transparent, regulated, and efficient platform for capital raising and trading, the BVM contributes to greater financial discipline and corporate governance among listed companies. This, in turn, makes the Mozambican market more attractive to both domestic and international investors who prioritize stability and clear operational frameworks. The presence of a robust stock exchange acts as an unequivocal sign of confidence in the country's economy. Furthermore, the BVM's efforts to attract more companies and increase market capitalization are intrinsically linked to enhancing the overall competitiveness of the country. When businesses can access capital more easily and efficiently through the stock market, they are better positioned to expand, innovate, and compete globally. This fosters a more dynamic and resilient economy, capable of weathering external shocks and seizing new opportunities. The BVM's strategic direction is therefore not just about financial market growth, but about broad-based economic empowerment.The Transformative Journey: From Public to Private Entity

A significant development in the evolution of the Mozambique Stock Exchange (BVM) has been its transformation from a public institution into a limited company. This strategic transition, initiated recently, represents a pivotal shift in its operational model and financial objectives. The primary aim behind this move is to maximize the institution's income and, consequently, improve state revenue. By operating as a limited company, the BVM gains greater flexibility and autonomy in its management and investment decisions, allowing it to pursue commercial opportunities more aggressively and efficiently. This transformation is also geared towards a broader strategic goal: to attract economically significant entities to list on the exchange. As a private entity, the BVM can potentially offer more competitive services, respond faster to market demands, and innovate in ways that might have been constrained under a purely public structure. This shift is designed to enhance the BVM's appeal to large, established companies, as well as promising growth enterprises, thereby deepening the market and increasing its overall liquidity and dynamism. It's a clear signal that the BVM is adapting its structure to better serve its ambitious growth targets and solidify its position as a leading financial center.BVM's Services and Offerings: Empowering Investors and Businesses

The Bolsa de Valores de Moçambique (BVM) serves as a comprehensive resource for both potential and existing participants in Mozambique's financial markets. Its official website, for instance, provides a wealth of information crucial for navigating the exchange. This includes detailed insights into its trading services, outlining how securities are bought and sold, and the various instruments available for investment. The website also clearly delineates the products and services offered, catering to a diverse range of financial needs, from equity and debt instruments to other specialized offerings. Crucially, the BVM ensures transparency and adherence to regulatory standards by providing comprehensive information on its rules and regulations. This legal framework is vital for maintaining investor confidence and ensuring fair and orderly market operations. Furthermore, the platform offers extensive market details, including real-time data, historical trends, and analytical tools, empowering investors to make informed decisions. The BVM also publishes various reports and documents regarding the stock market, serving as a valuable source of research and insights for all stakeholders. This commitment to providing accessible and detailed information underscores the BVM's role as a facilitator of informed financial engagement.A Comprehensive Platform for Financial Engagement

The BVM's offerings extend beyond mere information dissemination. It is designed to be a holistic ecosystem for financial engagement. For investors, it provides the opportunity to participate directly in Mozambique's economic growth, allowing individuals and institutions to contribute to national development while simultaneously seeking financial rewards. This dual benefit makes investing through the BVM a compelling proposition for those looking for impact alongside returns. For companies, the BVM is a vital conduit for capital. It provides a structured and efficient mechanism to raise funds for expansion, innovation, and operational needs. This access to capital is critical for businesses to scale, create jobs, and ultimately drive the real economy. The BVM's commitment to organizing, managing, and maintaining a central market for securities ensures that this process is conducted with integrity and efficiency, fostering a trustworthy environment for both issuers and investors. The breadth of "Sobre a BVM, produtos e serviços, negociação, legislação, publicações, CVM, investidores, empresas, membros, estatísticas" (About BVM, products and services, trading, legislation, publications, CVM, investors, companies, members, statistics) available on its platform speaks to its comprehensive approach.BVM's Rising Profile: Recognition on the African Stage

The strategic efforts and operational improvements at the Mozambique Stock Exchange (BVM) have not gone unnoticed on the continent. The exchange has notably moved up two places in the Absa Africa Financial Markets Index, a significant recognition of its growing sophistication and attractiveness. This index assesses the openness, depth, and transparency of financial markets across Africa, providing a benchmark for investors and policymakers. The BVM's improved ranking indicates enhanced market infrastructure, better regulatory frameworks, and increased liquidity, making it a more competitive and appealing destination for capital. This upward trajectory in such a respected index is a testament to the BVM's commitment to continuous improvement and its strategic plan. It signals to international investors that Mozambique's capital market is maturing and aligning with best practices in the region. Such recognition is crucial for attracting foreign direct investment and portfolio flows, which are vital for financing large-scale projects and driving sustainable economic development. The BVM's rising profile on the African stage reinforces its credibility and strengthens its position as a key player in the continent's financial landscape.Investing in Mozambique's Future: The BVM Opportunity

Investing in the Mozambique Stock Exchange (BVM) presents a unique opportunity for individuals and institutions to participate directly in the nation's economic ascent. As the BVM itself states, "Ao investir na BVM, indivíduos e instituições podem contribuir para o desenvolvimento económico de Moçambique enquanto colhem recompensas financeiras" – by investing in the BVM, individuals and institutions can contribute to Mozambique's economic development while reaping financial rewards. This dual benefit of social impact and financial return makes the BVM an attractive proposition, particularly for those with a long-term investment horizon. The broader economic context in Mozambique, while facing challenges such as increased domestic debt (the government increased domestic debt by 54.5 billion meticais to 275.1 billion meticais through treasury bonds to finance its fiscal deficit), also shows signs of positive shifts. The return of donor funding, such as the USD 470 million package approved by the IMF, signals renewed international confidence and provides crucial support for the country's fiscal stability. This blend of domestic financial management and external support creates a more stable environment for capital markets to thrive. The BVM, therefore, serves as a crucial conduit for channeling both local and international capital into productive sectors, helping to finance growth and mitigate economic pressures. Its role in mobilizing resources is more critical than ever, making it a focal point for those looking to invest in Mozambique's promising future.Contact and Further Information

For those seeking more detailed information about the Mozambique Stock Exchange (BVM), its operations, or investment opportunities, the institution provides accessible contact details and a comprehensive online presence. The physical address of the BVM is Avenida 25 de Setembro, N° 1230, 5º andar, Bloco 5. This central location in Maputo facilitates direct engagement for businesses and investors. For telephonic inquiries, the BVM can be reached at Fixo 21 30 88 26, with a fax number available at 21 31 05 59. Furthermore, the official website serves as the primary digital gateway, offering a wealth of information on trading services, products, rules and regulations, market details, and publications regarding the stock market. It is also where one can find details on "Sobre a BVM, produtos e serviços, negociação, legislação, publicações, CVM, investidores, empresas, membros, estatísticas," available with a language selection option. The BVM encourages stakeholders to "Fique atento para mais actualizações e insights sobre a BVM e outros mercados financeiros" – stay tuned for more updates and insights on the BVM and other financial markets, emphasizing its commitment to ongoing communication and transparency.In conclusion, the Mozambique Stock Exchange (BVM) stands as a testament to Mozambique's commitment to economic development and financial market sophistication. Its ambitious 2028 targets, strategic transformation, and rising profile on the African stage underscore its pivotal role in boosting the real economy and attracting crucial investment. The BVM is not just a trading platform; it is a dynamic financial center poised to drive the nation's prosperity.

- What Nationality Is Katie Miller

- Uncle June Pizza

- Mamie Gummed

- Terrel Williams Boxing

- How Did Konerak Sinthasomphone Die

As the BVM continues its journey to become a central hub for successful investments and businesses, its impact on enhancing the overall business environment and strengthening national competitiveness will only grow. We encourage you to explore the opportunities presented by the BVM and consider how you can contribute to, and benefit from, Mozambique's burgeoning economic landscape. Share your thoughts in the comments below, and stay tuned for further updates on the exciting developments at the BVM.

- How Old Is Kevin Bacon

- Erome Aidnilove

- Mm2 Values Trading

- Aireal Distance Between Iran And Israel

- Johnny Rivers Today

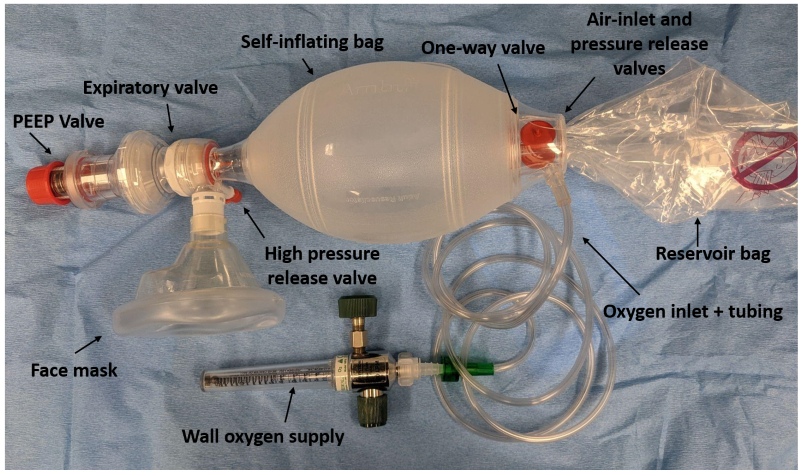

Critical Care Device Series: Bag-Valve-Mask EMRA

The Dos and Don'ts of Bag-Valve Mask Ventilation - JEMS: EMS, Emergency

Introducing the CPR-2+ Adult BVM with Tidal Volume Markings