Unlocking Potential: The Mozambique Stock Exchange (BVM) And Its Vision

The Mozambique Stock Exchange (BVM) stands as a pivotal institution in the nation's economic landscape, serving as a dynamic hub for capital mobilization and investment. This burgeoning financial center, often referred to simply as BVM, is not just a marketplace for securities; it is a catalyst for sustainable growth, offering immense potential for both domestic and international investors. Its strategic importance cannot be overstated, as it plays a crucial role in channeling funds from savers to productive investments, thereby fostering job creation and economic diversification across Mozambique.

This comprehensive guide delves into the intricate workings of the BVM, exploring its strategic ambitions, recent achievements, key services, and the profound impact it has on Mozambique's journey towards economic prosperity. Understanding the BVM is crucial for anyone looking to engage with the Mozambican financial market or seeking opportunities for impactful investment. We will navigate its current state, future aspirations, and the mechanisms that underpin its operations, providing a holistic view of this vital financial institution.

Table of Contents

- The Mozambique Stock Exchange (BVM): A Growing Financial Powerhouse

- Strategic Ambitions: BVM's Vision for 2028

- Recent Milestones and Market Performance

- Leadership at the Helm: Pedro Frederico Cossa's Appointment

- Navigating the BVM: Products, Services, and Trading Mechanisms

- Investing in Mozambique: Opportunities Through BVM

- Regulatory Framework and Investor Protection

- The Future Outlook for BVM Moçambique

The Mozambique Stock Exchange (BVM): A Growing Financial Powerhouse

The Bolsa de Valores de Moçambique, or BVM, stands as a testament to Mozambique's burgeoning economic aspirations. It is not merely a trading floor; it is a vibrant and growing financial center with immense potential, poised to become a significant player in the Southern African financial landscape. For years, the BVM has been diligently working to foster a robust capital market, essential for sustainable economic development. Its existence provides a crucial platform for companies to raise capital, for investors to grow their wealth, and for the nation to fund its critical infrastructure and development projects.

- Population Iran

- Uncle June Pizza

- Gummer Actress

- Iran Population Latest Statistics

- Professional Candid Photography

The BVM's role extends beyond just facilitating trades. It acts as a barometer for the Mozambican economy, reflecting investor confidence and corporate performance. By providing a transparent and regulated environment for buying and selling securities, it instills trust among market participants, both local and international. This trust is fundamental for attracting the foreign direct investment and domestic savings necessary to propel Mozambique towards its economic objectives. The BVM's continuous efforts to modernize its operations and expand its offerings underscore its commitment to becoming a truly dynamic and accessible financial hub.

Strategic Ambitions: BVM's Vision for 2028

The Mozambique Stock Exchange (BVM) has laid out an ambitious and transformative strategic plan for the coming years, signaling its deep commitment to boosting the real economy. According to reports, including those from the newspaper *Notícias*, the BVM aims to practically double the number of listed companies, targeting an impressive 30 companies by 2028. This isn't just about increasing numbers; it's about diversifying the market, offering more investment opportunities, and providing more Mozambican businesses with access to public capital.

Furthermore, the BVM has set an equally ambitious goal for its market capitalization. By 2028, it aspires to achieve a market capitalization equivalent to 35% of Mozambique's Gross Domestic Product (GDP). This target is significant because market capitalization, which approximates the total value of all listed companies and securities, directly reflects the depth and liquidity of the stock market. Reaching 35% of GDP would signify a mature and robust capital market, capable of playing a much larger role in funding the nation's economic growth and reducing its reliance on traditional bank financing or foreign aid. These goals collectively underscore the BVM's vision to be a central pillar in Mozambique's economic future, fostering an environment where businesses can thrive and investors can find compelling opportunities.

Recent Milestones and Market Performance

The strategic vision of the Mozambique Stock Exchange (BVM) is already showing tangible results, as evidenced by its recent market performance. The institution reported a remarkable growth of 5% in its market capitalization during the last quarter of 2024. This significant increase pushed the total market capitalization to 212.4 million meticais, equivalent to approximately 3 million US dollars. This growth is not merely a statistic; it represents a historic milestone for the exchange.

The surge in market value indicates a growing confidence among investors and an expanding pool of listed companies and securities. For the BVM, seeing its market value—a direct approximation of the total worth of all listed entities—reach such a level signifies a positive trajectory. It reflects successful efforts in attracting new listings, improving market liquidity, and enhancing investor engagement. This upward trend is crucial for the BVM as it strives towards its ambitious 2028 targets, demonstrating that the foundational work is indeed yielding positive returns and setting the stage for even greater expansion in the years to come.

Leadership at the Helm: Pedro Frederico Cossa's Appointment

Leadership plays a pivotal role in steering any financial institution, and the Mozambique Stock Exchange (BVM) recently welcomed a new figure at its helm. Pedro Frederico Cossa has been appointed as the new Chairman of the Board of Directors (PCA) of the BVM. This appointment marks a significant transition, as Cossa steps into the shoes of Salim Valá, who has moved on to assume the critical role of Minister of Planning and Development. Such changes at the top often signal new strategic directions or a reinforcement of existing ones, bringing fresh perspectives and renewed vigor to the institution's objectives.

Pedro Frederico Cossa's background and experience will undoubtedly be instrumental in guiding the BVM through its ambitious growth phase. His leadership is expected to be key in navigating the complexities of the financial market, fostering innovation, and ensuring the BVM remains a stable and attractive platform for investment. The continuity and evolution of leadership are vital for maintaining investor confidence and driving the strategic initiatives necessary to achieve the BVM's long-term goals, including its vision for doubling listed companies and significantly increasing market capitalization by 2028.

Navigating the BVM: Products, Services, and Trading Mechanisms

Understanding the operational core of the Mozambique Stock Exchange (BVM) involves delving into its diverse range of products, essential services, and the sophisticated mechanisms that facilitate trading. The BVM is designed to be a comprehensive financial ecosystem, catering to the needs of various market participants, from individual investors to large corporations.

Diverse Products and Services

The BVM offers a wide array of products and services, reflecting its commitment to a robust and diversified capital market. Its official website, for instance, highlights sections dedicated to "Sobre a BVM" (About BVM), "Produtos e Serviços" (Products and Services), "Negociação" (Trading), "Legislação" (Legislation), "Publicações" (Publications), "CVM" (Central Securities Depository), "Investidores" (Investors), "Empresas" (Companies), "Membros" (Members), and "Estatísticas" (Statistics). This comprehensive structure indicates a well-rounded institution that provides transparent information and various avenues for engagement.

In a strategic move to strengthen and diversify financing options within the capital market, the BVM has also announced a series of new financial products. These innovations promise to transform the landscape of alternative financing in the Mozambican economy. Such new offerings are crucial for attracting a broader base of investors and for providing companies with more flexible and tailored ways to raise capital, thereby contributing significantly to economic dynamism and growth.

The Automated Trading System

At the heart of the BVM's efficiency lies its automated trading system. The negotiation of securities listed on the Mozambique Stock Exchange occurs within this sophisticated electronic system, which is segmented into two primary components. This automation ensures speed, transparency, and fairness in all transactions, minimizing human error and maximizing market integrity. The two components likely refer to different segments of the market or different types of trading sessions, designed to cater to various liquidity needs and security types.

An automated system is indispensable for a modern stock exchange, as it allows for real-time price discovery and efficient order matching. This technological backbone is critical for attracting both local and international investors who rely on swift and reliable execution of their trades. The BVM's investment in such a system demonstrates its commitment to operating at international standards and providing a seamless trading experience for all participants.

The Central Securities Depository (CVM)

Integral to the smooth functioning of the BVM is the Central Securities Depository (CVM), a service created by Decree No. 25/2006 of August 23. The CVM is a critical component of the post-trade infrastructure, often described as the "fourth and final part" of the securities market service chain. Its primary function is to hold securities in electronic form, thereby eliminating the need for physical certificates. This dematerialization process significantly reduces the risks associated with theft, loss, or damage of physical documents.

Beyond safekeeping, the CVM also plays a crucial role in facilitating the clearing and settlement of trades. When a transaction occurs on the BVM, the CVM ensures that the transfer of ownership from seller to buyer is executed efficiently and securely. This process involves updating ownership records and ensuring that cash payments are made. By providing a centralized, secure, and efficient system for managing securities and settling trades, the CVM enhances market integrity, reduces operational costs, and boosts investor confidence in the Mozambique Stock Exchange.

Investing in Mozambique: Opportunities Through BVM

The Mozambique Stock Exchange (BVM) presents a compelling gateway for individuals and institutions looking to engage with one of Africa's most promising frontier markets. Investing in the BVM is not merely about financial returns; it is also a direct contribution to the economic development of Mozambique. This dual benefit makes the BVM an attractive proposition for those seeking both financial rewards and a positive societal impact.

Benefits for Investors

For investors, the BVM offers a unique opportunity to tap into the growth story of Mozambique. As the country continues to develop its natural resources, diversify its economy, and improve its infrastructure, companies listed on the BVM are well-positioned to capitalize on these trends. By purchasing shares or other securities, investors can participate directly in the success of these companies, potentially reaping financial rewards through capital appreciation and dividends. Furthermore, investing in an emerging market like Mozambique can offer portfolio diversification benefits, potentially providing higher returns than more mature markets, albeit with a commensurate level of risk.

The BVM's commitment to transparency and a regulated environment also provides a degree of assurance to investors. Access to public information, legislative frameworks, and statistical data allows for informed decision-making. As the BVM grows, so too will the liquidity of its market, making it easier for investors to enter and exit positions, further enhancing its appeal.

Benefits for Companies

For Mozambican companies, listing on the BVM offers a powerful avenue for growth and expansion. Going public allows companies to raise significant capital from a broad base of investors, which can be used to fund new projects, expand operations, or reduce debt. This access to public financing often comes with more flexible terms than traditional bank loans, providing companies with greater strategic autonomy.

Beyond capital, listing on the BVM enhances a company's visibility, credibility, and public image. Being a publicly traded entity often leads to increased brand recognition, improved corporate governance practices, and a stronger reputation, both domestically and internationally. This can attract more talent, foster stronger business partnerships, and ultimately contribute to the company's long-term sustainability and success, aligning perfectly with the BVM's goal of boosting the real economy.

Regulatory Framework and Investor Protection

A robust and transparent regulatory framework is the cornerstone of any trustworthy financial market, and the Mozambique Stock Exchange (BVM) operates within a defined legislative environment designed to protect investors and ensure market integrity. The BVM's commitment to adhering to established laws and regulations, as highlighted by its "Legislação" section, is crucial for fostering confidence among both domestic and international participants.

The presence of a clear legal framework, which governs everything from listing requirements to trading rules and investor conduct, helps to mitigate risks and ensure fair play. Institutions like the Central Securities Depository (CVM), established by specific decrees, further reinforce this protective layer by ensuring secure and efficient settlement processes. For investors, understanding that there are rules in place to prevent fraud, ensure transparency, and provide recourse in case of disputes is paramount. This regulatory oversight not only safeguards individual investments but also contributes to the overall stability and credibility of the Mozambican capital market, making the BVM a more reliable platform for financial engagement.

The Future Outlook for BVM Moçambique

The future for the Mozambique Stock Exchange (BVM) appears bright, characterized by ambitious goals and a clear strategic direction. With its sights set on significantly increasing the number of listed companies to 30 and achieving a market capitalization equivalent to 35% of the country's GDP by 2028, the BVM is positioning itself as a central engine for Mozambique's economic transformation. These targets are not merely aspirational; they are backed by recent growth, new leadership, and a commitment to diversifying financial products and modernizing trading mechanisms.

The BVM's role in mobilizing capital, fostering corporate growth, and offering investment opportunities is set to expand significantly. As Mozambique continues its development trajectory, the BVM will be an increasingly vital conduit for channeling both domestic savings and foreign investment into productive sectors of the economy. This sustained growth will not only benefit investors through potential financial rewards but will also contribute directly to job creation, infrastructure development, and overall national prosperity. The journey ahead for the BVM is one of continued expansion and increasing influence, solidifying its status as a key player in the nation's financial landscape. Fique atento para mais actualizações e insights sobre a BVM e outros mercados financeiros.

Conclusion

The Mozambique Stock Exchange (BVM) is undeniably a dynamic and growing financial center, brimming with immense potential to shape the economic future of Mozambique. From its ambitious strategic goals of doubling listed companies and significantly boosting market capitalization by 2028, to its recent milestones of robust growth in market value, the BVM is on a clear upward trajectory. The appointment of new leadership under Pedro Frederico Cossa, coupled with the continuous innovation in products, services, and its efficient automated trading system, reinforces its commitment to becoming a modern and accessible investment platform.

Investing in the BVM offers a compelling opportunity for both individuals and institutions to contribute directly to Mozambique's economic development while simultaneously pursuing their financial objectives. The robust regulatory framework and the essential role of the Central Securities Depository (CVM) further enhance trust and security for all market participants. As the BVM continues to evolve and expand, it will undoubtedly play an even more critical role in mobilizing capital, fostering corporate growth, and ultimately driving the prosperity of the Mozambican nation. We encourage you to explore the opportunities that the BVM presents and stay informed about its exciting developments. What are your thoughts on the potential of emerging markets like Mozambique? Share your insights in the comments below!

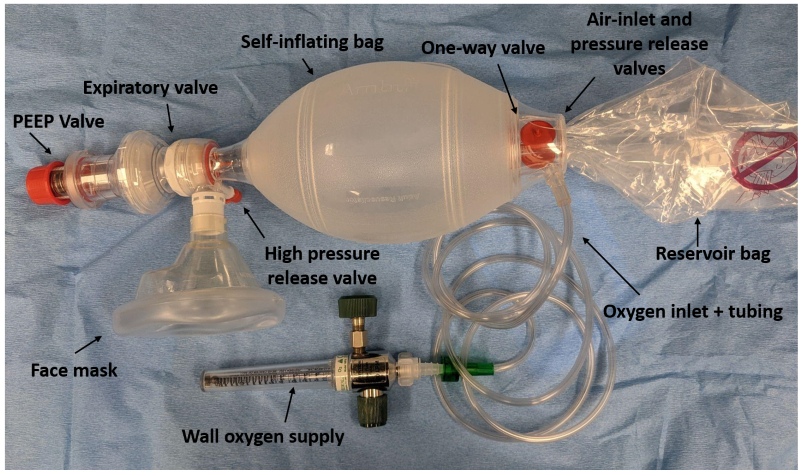

Critical Care Device Series: Bag-Valve-Mask EMRA

The Dos and Don'ts of Bag-Valve Mask Ventilation - JEMS: EMS, Emergency

Introducing the CPR-2+ Adult BVM with Tidal Volume Markings