Marcus Goldman Sachs - Your Money Companion

When you think about your money, it's pretty common to have some things you're hoping to achieve, isn't it? Maybe you're saving up for a big purchase, or perhaps you're just looking to put some money aside for a rainy day. Well, Marcus by Goldman Sachs, it seems, really cares about assisting people with those very personal money aims. They've made it a core part of what they do, actually, to stand by folks as they work towards what they want financially. This approach, you know, aims to make handling your money feel less like a chore and more like a helpful step forward.

This particular online bank, Marcus by Goldman Sachs, comes from a name many people recognize in the money world. It's part of Goldman Sachs, a rather big player in financial dealings. So, when you consider putting your money with Marcus, you're tapping into a long history of financial experience. They’ve got a long track record, more than 150 years, of working with money matters, which, in some respects, provides a certain kind of reassurance for folks looking for a place for their savings.

The idea here is pretty simple: provide straightforward financial products that help everyday people get closer to their money hopes. Whether it's about setting aside funds or finding a good spot for a lump sum, Marcus aims to offer ways to manage your cash with a friendly touch. It’s about making sure you have the necessary details at the correct time, so you can make thoughtful choices about your own funds, which, you know, is really quite helpful.

- Ali Khamenei Current Position Iran Supreme Leader

- Cuthbert Elisha

- Of Music And Dramatic Art

- Ben Napier Next Project

- Mamie

Table of Contents

- What Makes Marcus by Goldman Sachs a Good Choice?

- How Does Marcus by Goldman Sachs Help You Save?

- What About Certificates of Deposit from Marcus by Goldman Sachs?

- Where Can You Find Support for Marcus by Goldman Sachs?

- The Bigger Picture - Goldman Sachs' Legacy

- Thinking About Your Financial Path

- Understanding Consumer Finances

- Getting Started with Marcus by Goldman Sachs

What Makes Marcus by Goldman Sachs a Good Choice?

One of the first things people often wonder about any financial service is what makes it stand out. With Marcus by Goldman Sachs, it seems they’ve really put thought into making things simple and accessible for everyday folks. They have a clear aim: to help you get where you want to be with your money. This means they are pretty focused on offering products that are straightforward and easy to use, which, you know, can be a big relief when you're dealing with personal finances.

Marcus Goldman Sachs - A Focus on Your Financial Aspirations

The whole idea behind Marcus by Goldman Sachs appears to be about supporting your money dreams. They talk about helping customers reach their financial goals, which, honestly, is a very comforting thought for anyone trying to put a little extra aside or grow their savings. They're not just about holding your money; they're about being a part of your progress, offering tools and accounts that are built with your future in mind. This commitment to personal money aims is, you know, quite a central part of their approach.

When you consider what Marcus by Goldman Sachs offers, it's clear they keep the customer's needs in sharp view. They want to make sure that whatever money decisions you make with them really fit what you're trying to achieve. This means providing clear information and simple options, so you can feel good about where your money is going. It's about being a helpful partner in your financial life, which, for many, is a very welcome way to think about a bank.

- Iran Muslim Population

- Distance Between Iran And Israel Borders Middle East

- Kylie Mcdevitt

- Gummer Actress

- Johnny Rivers Today

How Does Marcus by Goldman Sachs Help You Save?

When it comes to putting money aside, people often look for places that make it easy and rewarding. Marcus by Goldman Sachs seems to understand this pretty well. They offer online savings accounts that are designed to be straightforward. You can open one up and start putting money in without a lot of fuss, which is, you know, a common desire for people looking to build up their cash reserves.

Exploring Savings with Marcus Goldman Sachs

One thing that stands out about the savings accounts from Marcus by Goldman Sachs is that they have no minimum deposit requirements. This is a pretty neat feature, as it means you don't need a huge sum of money to get started. You can begin saving with whatever amount you're comfortable with, which, for a lot of people, makes the idea of saving much less intimidating. It's about opening the door to saving for everyone, regardless of how much they have to begin with.

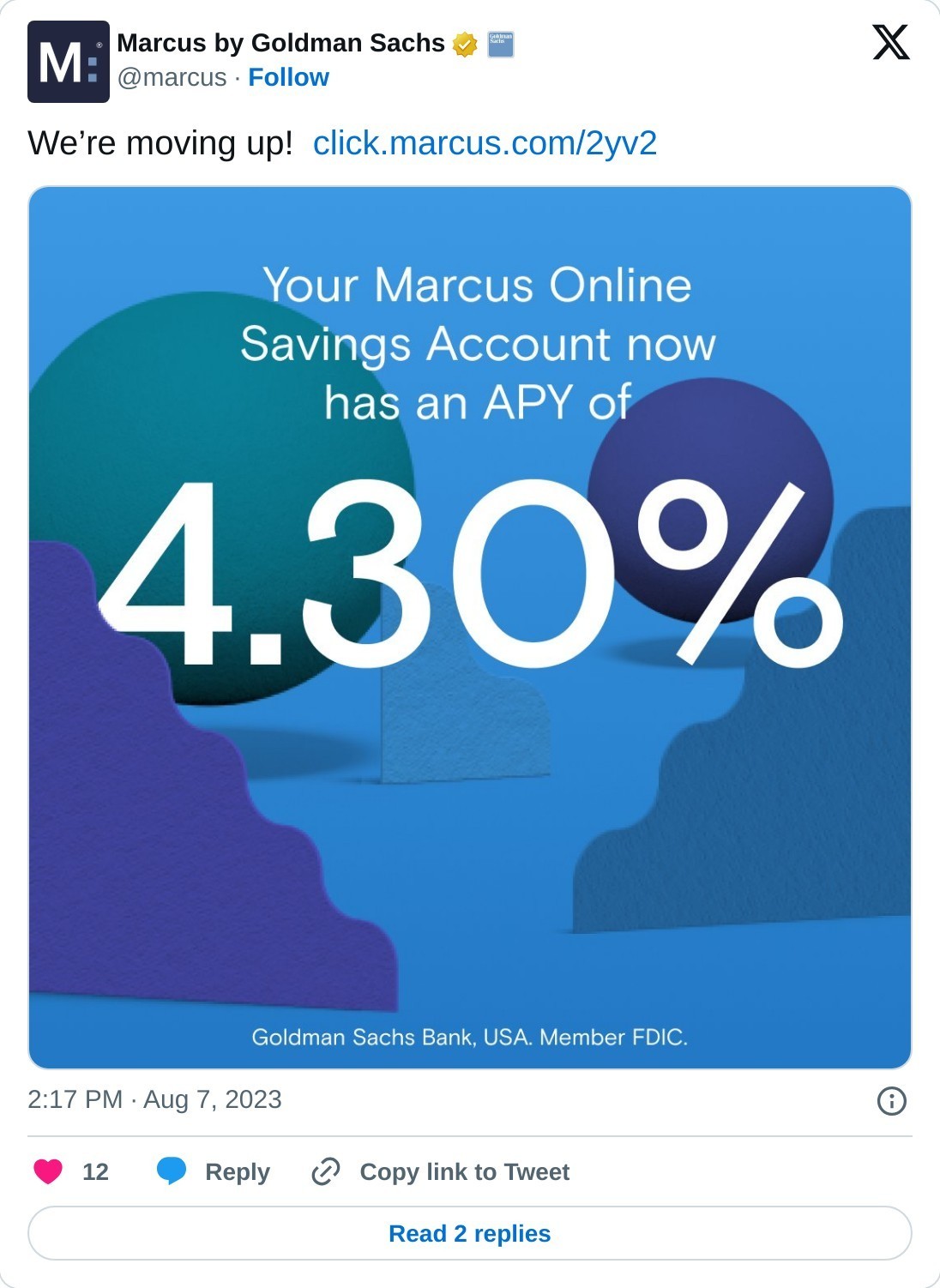

These online savings accounts also come with rates that are generally quite good. They aim to provide competitive, high yield rates, which means your money has a better chance of growing while it sits there. This is, you know, a pretty important detail for anyone who wants their savings to work a little harder for them. The idea is that your money earns a decent return, helping you reach those personal financial aspirations a bit faster.

It's about providing a simple place to keep your money, where it can also earn a little extra. Marcus by Goldman Sachs focuses on making this process as clear as possible, so you can feel confident about your choice. They want to be a helpful hand in your saving efforts, making it easier to accumulate funds for whatever your future holds. So, in some respects, it's about simplicity and earning potential wrapped into one.

What About Certificates of Deposit from Marcus by Goldman Sachs?

Beyond just regular savings accounts, Marcus by Goldman Sachs also offers another way to put your money aside for a set period: Certificates of Deposit, or CDs. These are typically for money you don't need right away, where you agree to keep it untouched for a certain length of time in exchange for a fixed rate of return. It's a way to lock in an earning rate, which, for some people, provides a sense of security about their future money.

CD Options with Marcus Goldman Sachs

Marcus by Goldman Sachs provides various CD options, allowing you to pick a term that suits your own plans. They encourage you to check the best CD rates available, so you can make a choice that truly aligns with your personal money aims. This flexibility is, you know, quite valuable, as different people have different timelines for when they might need their funds.

Just like their savings accounts, the CDs from Marcus by Goldman Sachs also aim to offer competitive, high yield rates. This means that for the time your money is held in a CD, it’s working to generate returns at a good pace. It’s about giving your money a chance to grow steadily and predictably, which, for many, is a key reason to consider a CD. They want to make sure you have options that are both beneficial and straightforward.

Learning more about these CD rates from Marcus by Goldman Sachs is something they make easy to do. They want you to have all the information you need to decide if a CD is the right fit for your particular situation. It's about giving you the tools to make an informed choice, so you can feel good about where your funds are placed. So, in a way, they are trying to be very transparent about the opportunities available.

Where Can You Find Support for Marcus by Goldman Sachs?

Even with the most straightforward services, sometimes you just need to talk to someone or find an answer to a quick question. Marcus by Goldman Sachs understands this, and they make it pretty simple to get in touch. They want to ensure that if you have a query or need a bit of help, you can easily connect with them, which, you know, is a very important part of good customer care.

Getting in Touch with Marcus Goldman Sachs

You can discover all the different ways to contact Marcus by Goldman Sachs. They aim to provide various channels, so you can pick the one that works best for you, whether it's by phone, online, or perhaps another method. This focus on accessibility is a sign that they want to be there for their customers, making sure that support is readily available when it's needed. It's about creating a helpful experience, honestly, from start to finish.

Having reliable ways to communicate with your bank is something that builds trust. Marcus by Goldman Sachs seems to prioritize this, ensuring that finding assistance is a hassle-free experience. They want to make sure that if you have a question about your account, or perhaps about their offerings, you can get the answers you need without much difficulty. This dedication to being reachable is, you know, a pretty good sign of their customer focus.

The Bigger Picture - Goldman Sachs' Legacy

While Marcus is an online bank focused on consumer products, it's also important to remember that it comes from Goldman Sachs, a name with a very long and established history in the financial world. This connection means that Marcus benefits from a vast amount of experience and insight that has been built up over more than a century and a half. It’s like having a deep well of knowledge to draw from, which, you know, can be very beneficial.

Marcus Goldman Sachs and Broad Financial Wisdom

Goldman Sachs itself is known for its exceptional people and leaders, and for its insights into global markets and macroeconomic forces. This broader expertise, in a way, filters down to Marcus by Goldman Sachs. It means that the consumer products offered by Marcus are backed by a deep understanding of the financial world, which can provide a sense of confidence for customers. It's about having a strong foundation, actually, for the services they provide.

The idea that Marcus by Goldman Sachs is on a mission to help you make the most of your financial potential is truly supported by this extensive background. They offer a suite of consumer products, all of which are backed by that 150+ years of Goldman Sachs’ expertise. This long history suggests a certain level of experience and wisdom that can be quite reassuring when you're choosing a place for your money. So, in some respects, you're getting more than just an online bank; you're getting a piece of that long-standing financial insight.

Thinking About Your Financial Path

Making thoughtful decisions about your money is something that can feel a bit overwhelming at times. It really starts with having good, reliable information available to you, and, crucially, having it when you actually need it. Marcus by Goldman Sachs seems to put a lot of emphasis on this, aiming to provide the right details at the right moment, which, you know, can make a real difference in how you manage your funds.

Marcus Goldman Sachs and Making Thoughtful Money Decisions

Marcus is there to offer financial expertise and resources for all of life’s moments, whether they are big, significant changes or just small, everyday needs. This means they aim to be a source of helpful guidance throughout your financial journey, providing support for various situations. They also bring in economic insights and intelligence from across the wider Goldman Sachs organization, which can help you stay informed about the bigger money picture. It’s about giving you a broader view, honestly, to assist your choices.

The idea is to equip you with the details you need to make smart choices for your money. Marcus by Goldman Sachs wants to be a helpful presence, offering clear, understandable information that can guide you. They understand that having timely and accurate insights can make a significant difference in how you plan and save. So, in a way, they are trying to be a helpful guide, offering a little bit of wisdom along the way.

Understanding Consumer Finances

A significant part of offering helpful financial services is truly grasping what's happening with everyday people's money. Goldman Sachs, through its research, keeps a close watch on the financial well-being of consumers, especially in places like the United States. This ongoing study helps them stay connected to the real-world money situations of individuals, which, you know, is pretty important for creating relevant products.

Insights from Marcus Goldman Sachs on Consumer Well-being

You can actually get the latest insights from Goldman Sachs research on the financial health of the US consumer. This kind of information is quite valuable because it helps everyone, including Marcus by Goldman Sachs, understand the current money climate. It’s about staying informed about how people are doing financially, which then helps them shape their offerings to better suit those needs. This focus on real-world data is, you know, quite a thoughtful approach.

By keeping an eye on these trends, Marcus by Goldman Sachs can better understand the challenges and opportunities that people face with their money. This knowledge then informs how they refine their services and resources, making sure they are as helpful as possible. It’s about being responsive to the needs of the people they serve, ensuring that their financial products remain relevant and supportive. So, in some respects, it's about continuous learning and adaptation.

Getting Started with Marcus by Goldman Sachs

For anyone considering an online savings account or a CD, the process of getting started should be as smooth as possible. Marcus by Goldman Sachs aims for simplicity here, making it straightforward to open an account and begin your saving journey. They want to remove any unnecessary hurdles, so you can focus on your money goals rather than complicated paperwork, which, you know, is a common desire for many people.

Simple Steps for Marcus Goldman Sachs Accounts

The whole process is designed to be user-friendly, allowing you to set up your account from the comfort of your own home. They provide clear instructions and support, so you don't feel lost at any point. This ease of access is a key part of their promise to help you make the most of your financial potential, ensuring that getting started is not a source of stress. So, it's almost about making financial management feel a little more approachable for everyone.

Whether you're looking to open an online savings account to build up your emergency fund or explore certificates of deposit for a longer-term plan, Marcus by Goldman Sachs makes the options clear. They want you to feel confident in your choices and in the simplicity of managing your funds with them. This focus on an easy start is, you know, a pretty important aspect of their overall customer approach, making it easier for people to take control of their money.

Marcus by Goldman Sachs on Tumblr

Marcus by Goldman Sachs High-Yield Savings Accounts Review : r

Marcus Goldman Sachs Legit Financial Options and Services